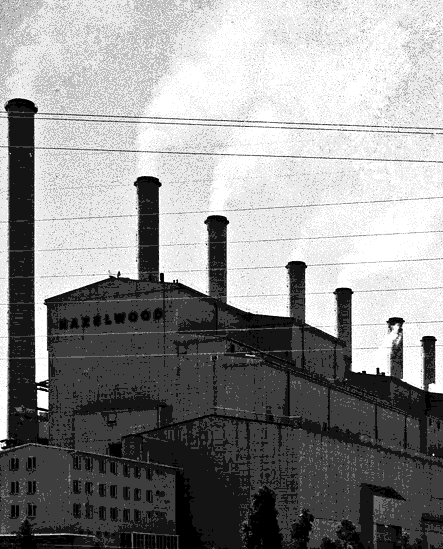

Coal closure profits shown

Research suggests shutting down coal-fired power stations can be profitable for investors.

Research suggests shutting down coal-fired power stations can be profitable for investors.

A new study from Griffith University challenges the prevailing belief that retiring coal-fired power plants early is financially unviable.

Contrary to common perceptions, researchers demonstrate that such early retirements can actually be profitable for investors, especially when combined with strategic financial tools and renewable energy investments.

The finding is particularly relevant as economies look for ways to transition from coal to cleaner energy sources in response to climate change.

The study, conducted in collaboration with Climate Smart Ventures and Fudan University, focuses on the financial feasibility of accelerating the shift from coal to renewable energy in countries like Vietnam and Pakistan.

“Our research offers a roadmap for implementing financially viable strategies to phase out coal power while expanding renewable energy capacity,” said Professor Christoph Nedopil, Director of the Griffith Asia Institute.

The research finds that younger coal plants, which typically have higher financing costs, can be retired earlier than older plants without reducing their enterprise value.

This is due to the potential for refinancing strategies that, when coupled with investments in renewable energy, can enhance the financial returns for coal plant owners.

In particular, the study suggests that coal plants in Vietnam and Pakistan could be retired 3 to 13 years ahead of schedule while still preserving or even increasing investor returns.

This challenges the conventional wisdom that younger plants, because of their longer operational life expectancy, are harder to retire early.

The research identifies several financial mechanisms that could facilitate this transition. Options such as blended finance, green bonds, and debt-for-climate swaps are highlighted as pivotal in enabling the early retirement of coal plants.

“With the right financial mechanisms, we can accelerate the retirement of coal plants in Asia without compromising investor returns,” said Professor Nedopil.

This, he added, “opens new avenues for addressing climate change while ensuring economic stability”.

The researchers argue that immediate refinancing actions, paired with renewable energy integration, not only support early coal plant retirement but also enhance enterprise values. The implications of this research are significant for policymakers, investors, and international financial institutions looking to support a shift away from coal in Asia.

By demonstrating that early retirement of coal plants can be profitable, the study provides a compelling argument for accelerating the global energy transition, with potential benefits for both the economy and the environment.

The full study is accessible here.

Print

Print